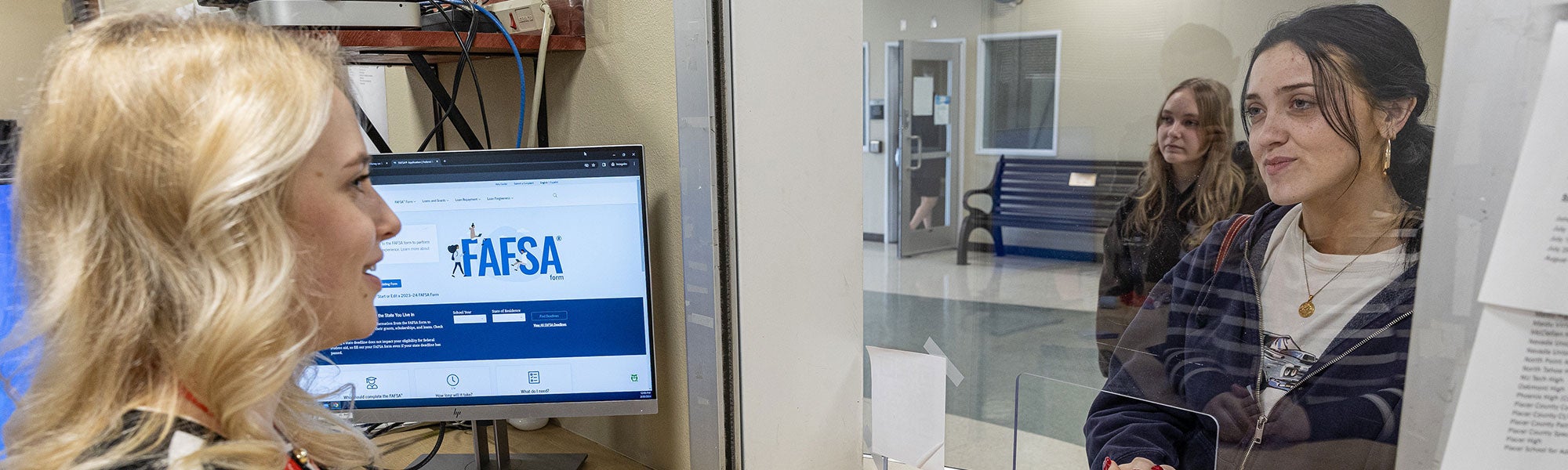

Financial Aid

Affordable Education

At Sierra College, we’re proud to offer an affordable education close to home. With financial aid, scholarships, and two years free, Sierra College can fit your budget.

Disclosures: Visit the Department of Education Required Disclosures for the Receipt and Use of HEERF I, II, III Grant Funds and Institutional Reporting.

opportunities

Tools

Find out if you qualify for financial aid. Before you apply for financial aid, use the:

- Visit I Can Go to College to learn how we can help you achieve your educational goals.

- Federal Student Aid Estimator to help you understand your options for paying for college.

- Sierra College Net Price Calculator to learn the estimated costs of attending college.

- Financial Aid disbursement calendar. Learn more about disbursements and refunds to help with your financial planning.

Ways to Pay

We offer a variety of financial aid options to help you pay for college tuition, fees, books and cost-of-living expenses.

Resources

Use these resources to stay on track and receive financial aid. Reach out if you have any questions.

- Consumer Protection Bureau

- Financial Aid How-to Articles

- Financial Aid Forms

- 2024-25 Financial Aid Handbook

- 2023-24 Financial Aid Handbook

- 2023-24 Financial Aid Policies

- 2023-24 Financial Aid Terms and Conditions

Privacy and Reinstatements

- Privacy Notifications/FERPA Guidelines

- Satisfactory Academic Progress (Petition Reinstatement, 90 Unit Limit Appeal)

Get In Touch

Financial aid can be confusing and overwhelming but we’re here to support you through each step of the process. Reach out to us if you have any questions.

Financial Aid Services — Rocklin

Building L

Financial Aid Services — Nevada County

Building N1, Room 112